Reading time:

8 min

Jevons Paradox, AI, and Why Seat Pricing Is Failing

Cheaper AI doesn’t mean fewer costs. For elastic work, per-seat pricing is Jevons Paradox in action - volume explodes, who pays?

Article written by

Shawn Curran

Most AI products today are priced like traditional software.

Per user. Per month. Often capped.

It feels familiar. Predictable. “Enterprise-ready.”

But as AI moves from automation into continuous analysis, this model is breaking.

Not because vendors are greedy. Not because customers misuse tools.

But because of Jevons Paradox.

When the cost of analysis falls, the volume of analysis rises.

And in many modern AI use cases, it will rise dramatically.

Jevons Paradox Meets Artificial Intelligence

Jevons Paradox describes a simple dynamic:

"When a resource becomes cheaper, people use more of it."

In computing, this has happened repeatedly:

Cheaper storage → more data

Faster networks → more traffic

Cheaper compute → more computation

AI is no different.

As model training and inference costs fall, organisations do not “save money”.

They analyse more.

They monitor more.

They evaluate more.

They run systems more often and on more data.

The result is not efficiency alone.

It is scale.

Two Types of AI Work

Not all AI workloads respond the same way to falling costs.

Broadly, they fall into two categories.

1. Static Work: Cost Falls, Volume Stays Flat

Some work has natural limits.

Examples across industries:

Financial audits

Transaction due diligence

Annual compliance reviews

One-off investigations

Pre-deal risk assessments

Take legal as an example:

IPO verification and M&A diligence happen only when a transaction happens.

If AI halves the cost, it does not double the number of IPOs.

The constraint is strategic and economic, not analytical.

In these domains:

Lower cost → higher margin

Lower cost → faster delivery

Lower cost → better quality

But not much more volume.

Jevons Paradox is weak here, which challenges the assumption Jevons applies to everything.

2. Elastic Work: Cost Falls, Volume Explodes

Other categories behave very differently.

These are ongoing, repeatable, and expandable.

Examples across industries:

Litigation discovery

Regulatory surveillance

Transaction monitoring

Fraud detection

Cybersecurity analysis

Realtime compliance

Enterprise-wide search

Take legal again:

Discovery costs strongly influence litigation strategy.

If discovery is expensive, cases settle.

If discovery becomes cheap, more cases proceed.

More cases → more documents → more discovery → more analysis.

Volume compounds.

In these domains:

Lower cost → more activity

More activity → more data

More data → more analysis

More analysis → higher total consumption

Jevons Paradox is strong.

This is where AI changes behaviour, not just productivity.

Why Seat Pricing Assumes the Wrong World

Most white-collar SaaS still prices by seat. Static work. No upside.

Every business has static parts and elastic parts.

Smart incumbents might buy seats for everyone, ditch static work, scale elastic work - huge value, but could end up crushing their supplier margins.

Smart suppliers might sell buckets of consumption to companies that will never play in elastic markets. Predictable, but capped.

Reality: buyers and sellers need to understand each other and align incentives.

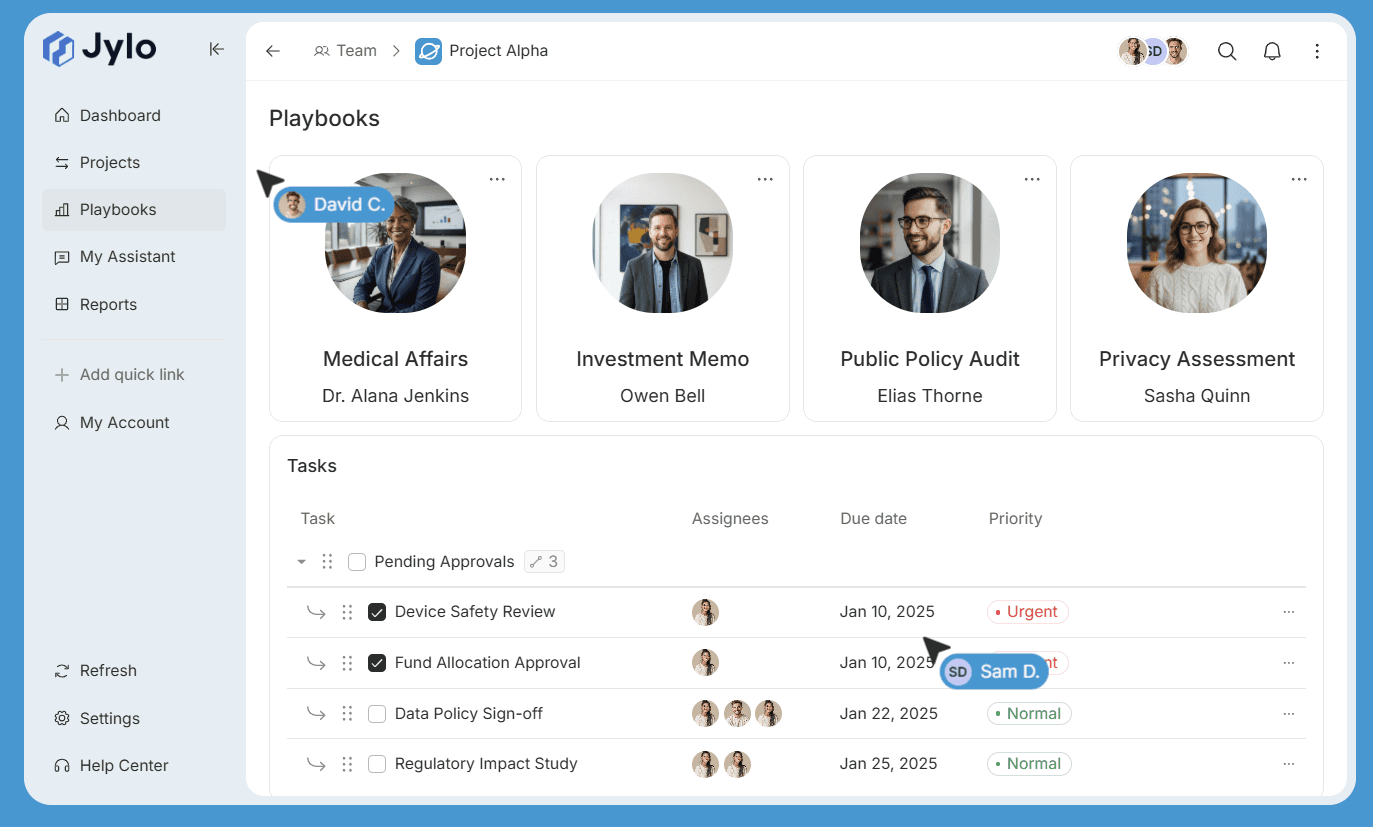

At Jylo, we price hybrid. Static work = price pressure. Elastic work = growth upside. We support customers as they figure out how they want to sell services in an AI future.

Why Seat Pricing Assumes the Wrong World

Per-seat pricing assumes:

Each user generates similar load

Usage is relatively stable

Marginal costs are low

Demand is predictable

This works for traditional software.

It works for document management systems. It works for CRM. It works for contract repositories.

It does not work for elastic AI workloads.

Because AI costs scale with:

Data processed

Queries run

Monitoring frequency

Reprocessing cycles

Model inference

Not with headcount.

When Jevons applies, users do not just “use AI better”.

They use it more.

Continuously.

Across more systems.

Across more scenarios.

Per-seat pricing does not capture this.

When Vendors Become the De Facto Buyer

In elastic domains, seat pricing creates a hidden transfer of risk.

The customer pays a fixed fee.

The vendor pays variable compute.

As volume grows, the vendor absorbs the cost.

Over time:

Heavy users dominate costs

Margins erode

Contracts become unprofitable

Subsidies appear

This is already happening quietly across AI markets.

Take some new Legal AI tools doing litigation discovery.

Under per-seat pricing:

The law firm pays £X per user.

But discovery volume grows with case volume, not staff.

The vendor effectively funds the litigation workload.

They become the buyer of compute on the client’s behalf.

This is not sustainable.

Consumption Pricing Reflects Jevons Reality

Consumption pricing aligns incentives differently.

It ties cost to:

Data processed

Documents analysed

Events monitored

Queries executed

Under this model:

If volume grows, spend grows.

If volume stays flat, spend stays flat.

The party creating demand carries the cost.

This is economically coherent under Jevons conditions.

It is how cloud infrastructure works. It is how telecoms works. It is increasingly how AI must work.

Why Some Buyers Resist Consumption

Many organisations prefer seats because they appear safer.

They offer:

Budget certainty

Predictable invoices

Simpler procurement

But this stability is often artificial.

It exists only while vendors subsidise growth.

Once usage scales, repricing becomes inevitable.

At that point, customers experience “bill shock” rather than gradual adjustment.

Reframing Commercial Relationships

As AI moves into monitoring, compliance, and continuous analysis, vendor–customer relationships are changing.

The old model:

“Pay for access to software.”

The new reality:

“Pay for ongoing analytical activity.”

This requires more explicit decisions:

Which work should the customer scale?

Which should be constrained by the customer?

Who carries volume risk - supplier or customer?

Where is elasticity expected?

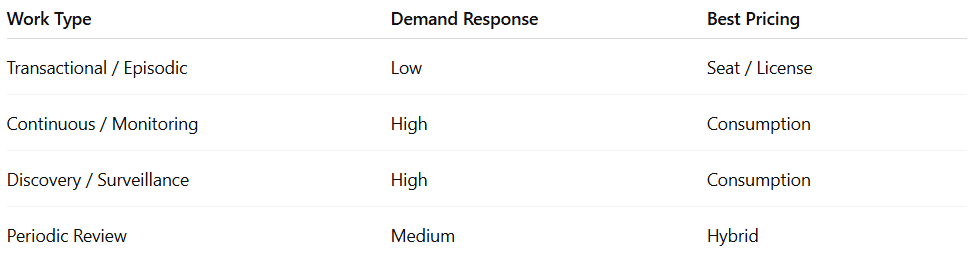

Mature buyers will increasingly segment their AI spend:

This is not about vendor preference.

It is about economic alignment.

The Strategic Implication

The next phase of AI adoption will not be driven by model quality alone.

It will be driven by pricing architecture.

As AI shifts from tools to infrastructure, Jevons Paradox becomes dominant.

Organisations that ignore this will face:

Rising hidden costs

Contract instability

Vendor churn

Budget volatility

Vendors that ignore it will face:

Margin compression

Capital dependency

Forced repricing

Customer backlash

Conclusion: Price for Behaviour, Not Access

AI is no longer just software.

It is an analytical utility.

In static domains, traditional pricing still works.

In elastic domains, it does not.

As monitoring, compliance, discovery, and surveillance become continuous and ubiquitous, volume will grow faster than headcount.

Seat pricing assumes a world where that does not happen.

Jevons Paradox guarantees that it will.

The sustainable model is simple:

Use seats where volume is naturally bounded

Use consumption where volume is elastic

Make volume risk explicit

Align incentives early

In the AI era, the central commercial question is no longer:

“How many users do you have?”

It is:

“How much analysis are you generating?”

And who is paying for it.

Article written by

Shawn Curran

AI that remains yours

Capture expertise and eliminate rework across your organisation.